Following are the facts you should know about Sales and service tax Malaysia. How does service tax works.

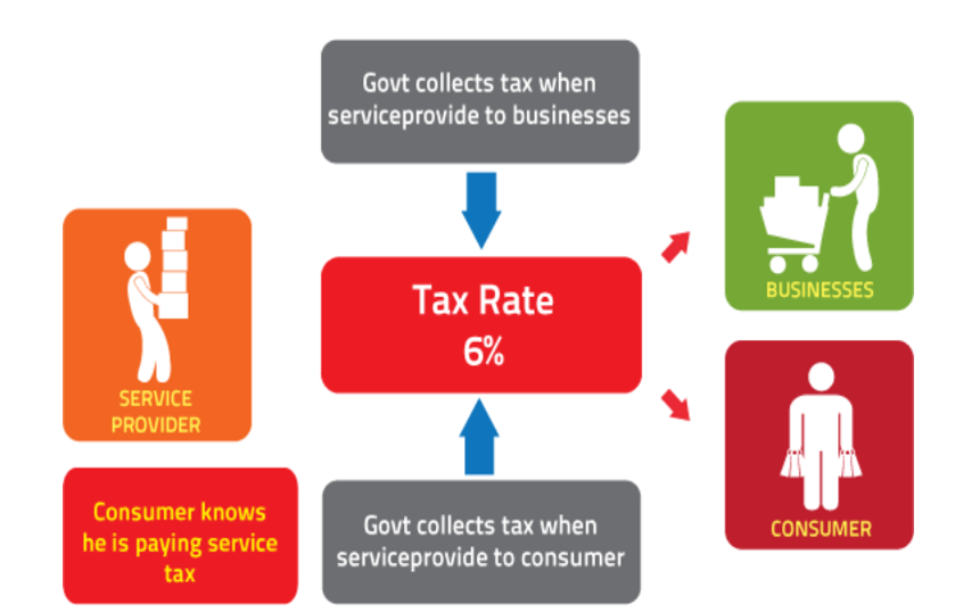

Please click on the links below to access the relevant legislation.

. Section 34B of the Income Tax Act 1967 Act 53. Part I PRELIMINARY Short title and commencement 1. Or b imported into Malaysia by any person.

Sales tax is not charged on goods listed under the Proposed Sales Tax Exemption from Registration Order. Furnishing of return for the last taxable period. Sec 81 Sales Tax Act 2018 A tax to be known as sales tax shall be charged and levied on all taxable goods a manufactured in Malaysia by a registered manufacturer and sold used or disposed of by him.

Pursuant to this please be advised that the new rate on transactions related to MYXpats charges will. In this regard the Goods and Services Tax Act 2014 has been repealed with effect from 1 September 2018. 1 This Act may be cited as the Service Tax Act 2018.

In accordance to the announcement made by the Malaysian Government on the implementation of Sales and Service Tax Act 2018 effective 1 Sept 2018 the Sales and Service Tax SST will be implemented at MYXpats Centre beginning 1 November 2018. Amendment to Service Tax Policy No. Such records or books of accounts must be maintained in Romanised Malay or in English.

If the application to vary the taxable. 6 rate has been enacted for Sales and service tax SST by. Protection of officer of goods and services tax from liability.

The Malaysian Sales Tax Act 2018 and Service Tax 2018 collectively Acts came into operation on 1 September 2018. Service tax is not charged on imported nor exported services. Circular No 2112018 Dated 4 Sept 2018 To Members of the Malaysian Bar As you are aware the Goods and Services Tax GST Act 2014 has been repealed and the Sales and Services Tax SST legislation came into effect on 1 Sept 2018.

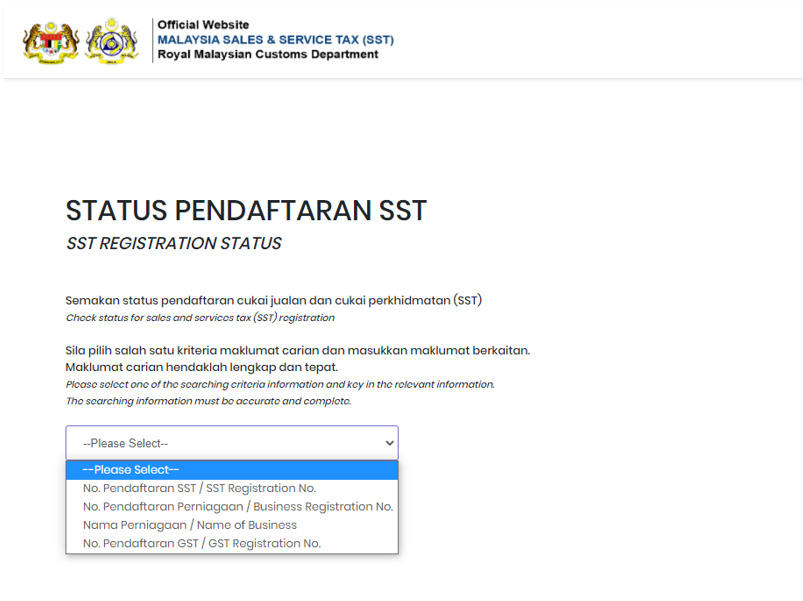

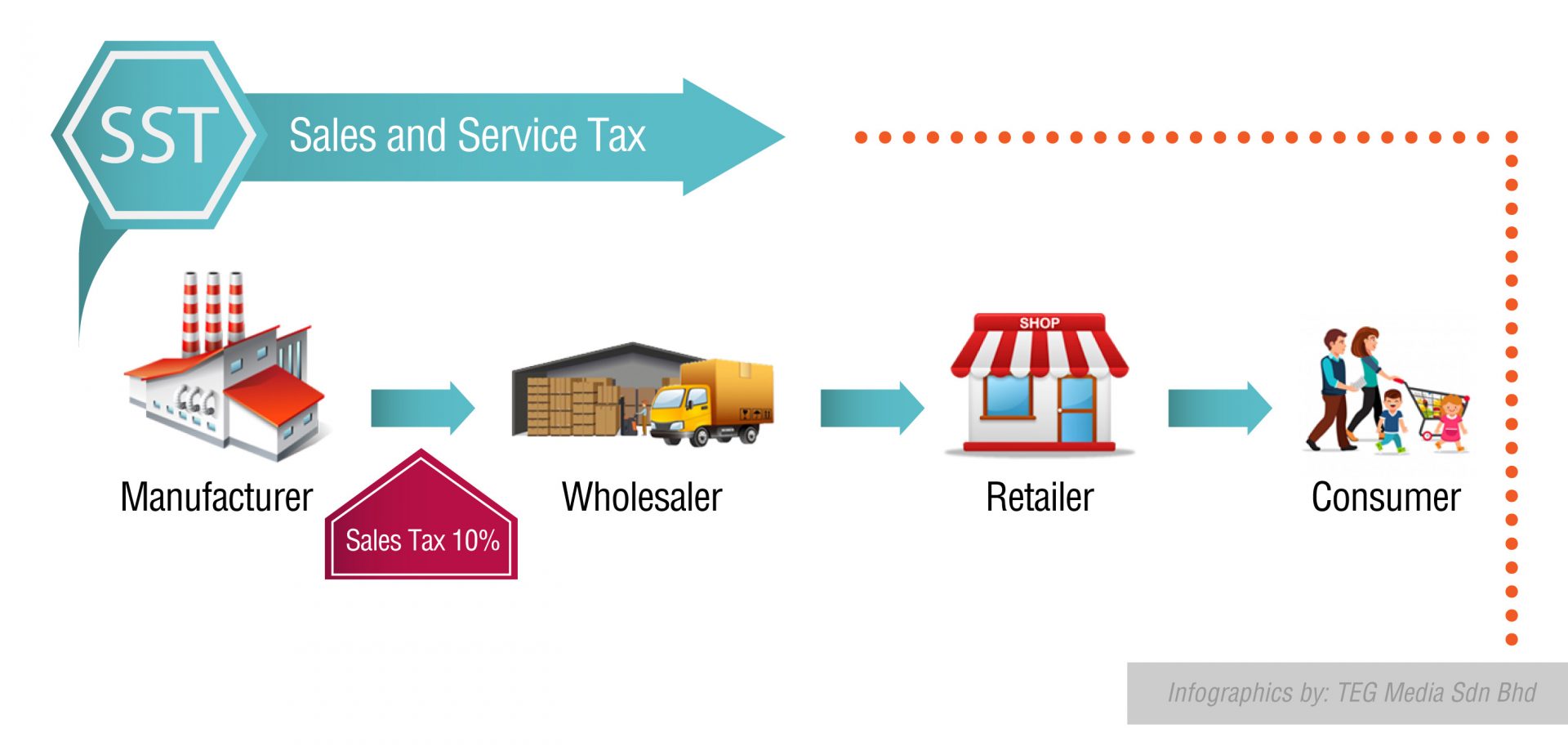

The Sales Tax is a single-stage tax charged and levied on taxable goods imported into Malaysia and on taxable goods manufactured in Malaysia by a taxable person and sold by him including used or disposed goods. Service Tax is exempted for services occurring on 31 December 2021 and ending 1 January 2022. It replaced the 6 Goods and Services Tax GST consumption tax which was suspended on 1 June 2018.

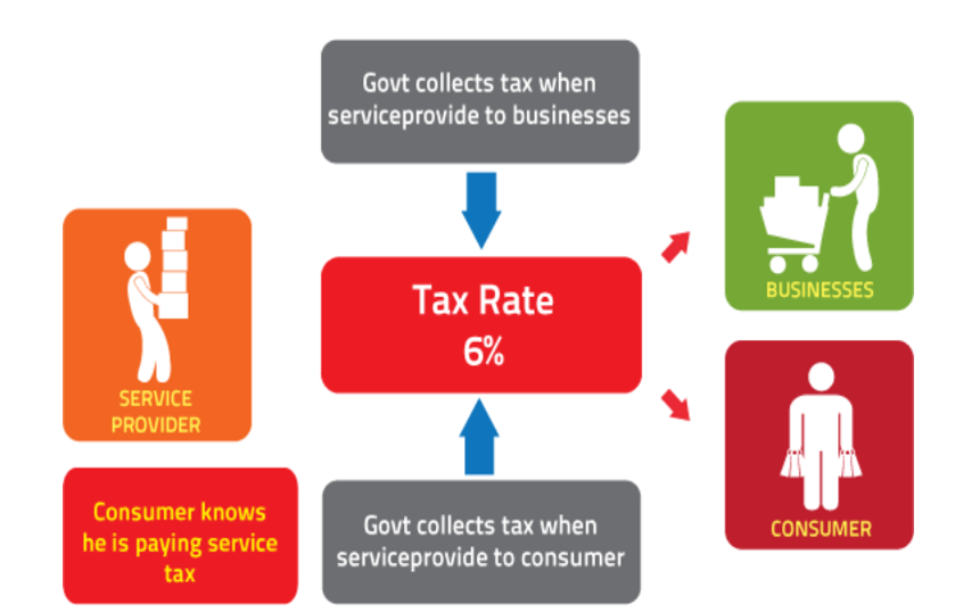

Malaysia reintroduced its sales and service tax SST indirect sales tax from 1 September 2018. Service Tax AmendmentNo 3 Regulations 2018. The service tax will stand at 6 and it would be levied on specific prescribed services provided by a taxable person in the course or furtherance of a business in Malaysia.

1 Goods and Services Tax Repeal Act 2018. Payment of sales tax when person not registered. Hotels Food and beverage Clubs Gaming Insurance and takaful Legal and accounting services.

Repeal and savings of sales Tax Act 1972. In Malaysia it is a mandatory requirement that all manufacturers of taxable goods are licensed under the Sales Tax Act 2018. The sales tax and service tax are intended to replace the goods and services tax.

Both manufacturers and service providers are liable to sign up for this service tax under the 2018 Act in Malaysia. Any sales tax that falls due during a taxable period is payable to the Royal Malaysian Customs Department RMCD latest by the last day of the month following the end of the taxable period. Power to make regulations.

SCOPE CHARGE Sales tax is not charged on. ENACTED by the Parliament of Malaysia as follows. Taxable person is a person who provides taxable services in the course or furtherance of business in Malaysia and is liable to be registered or is registered under the Service Tax Act 2018.

Or b the Federal or State Government local authorities. A taxable period is a period of 2 calendar months however a taxable person can apply to the DG of Customs to vary the taxable period. Sales and service tax is operated under the Sales Tax Act 2018 and the Service Tax Act 2018.

Persons exempted under Sales Tax Persons Exempted from. The Acts provide that the provision of services will be. Non- Service Tax registered person or Sales Tax registered manufacturer who is not registered for Service Tax.

2 This Act comes into operation on a date to be appointed by. Under the Sales Tax Act 2018 sales tax is charged and levied on taxable goods manufactured in Malaysia by a taxable person and sold unused or disposed by them and on taxable goods imported into Malaysia. REPEAL AND SAVINGS OF SALES TAX ACT 1972.

22019 Subject to meeting conditions Service Tax exemption on imported taxable services for companies in Labuan effective 1 September 2019 is now extended to 31 December 2021. REPEAL AND SAVINGS OF SERVICE. Who is the taxable person.

GST was only introduced in April 2015. The taxable services are as follows. Service Tax 9 An Act to provide for the charging levying and collecting of service tax and for matters connected therewith.

The Sales Tax Act 1972 also makes provisions for the production of invoices by computer. In addition it is the duty of every taxable person to maintain full and true records of all transactions involving the sales of taxable goods. SST is administered by the Royal Malaysian Customs Department RMCD.

Difference Between Sst Gst Sst Vs Gst In Malaysia 2020 Updated

About Sales And Service Tax Sst In Malaysia Help Center Wix Com

Gst What Is Happening To Taxes In Malaysia Gst Vs Sst Treezsoft Blog

Malaysia Sst Sales And Service Tax A Complete Guide

Sales And Service Tax Sst In Malaysia Transitional From Gst To Sst 2 0

Gst Vs Sst In Malaysia Mypf My

Sales And Service Tax Sst In Malaysia Transitional From Gst To Sst 2 0

Malaysia Sst Sales And Service Tax A Complete Guide

How Is Malaysia Sst Different From Gst

Malaysia Sst Sales And Service Tax A Complete Guide

Gst Better Than Sst Say Experts

Gst What Is Happening To Taxes In Malaysia Gst Vs Sst Treezsoft Blog

Sst Vs Gst How Do They Work Expatgo